As a retirement enthusiast, you have joined my weekly newsletter list and read along each month, and I hope you have found the information to be helpful and informative.

After all, I aim to provide you with the power, knowledge, and information you need to plan your retirement successfully.

And know, if you ever have a question, that’s what I’m here for.

Writing this newsletter is been both strange and rewarding.

Strange? Yes, because each week, I’m essentially writing into the void to many individuals who I’ve never met or heard from.

Yet, it’s been more rewarding than I could have ever imagined.

I’ve been encouraged by the questions that I’ve received, the topics you’ve asked me to write on, and the organic growth this newsletter has experienced.

It is an honor to be there for you in whatever form that takes.

I’ve had the opportunity to write on really fun topics like how to best spend money in retirement and tips on achieving fulfillment and I’ve also had the difficult task of speaking about what to do when you’ve experienced unexpected health issues or need to consider assisted living.

The truth of this business and what I love most about it is that it’s one constantly filled with emotion, both of celebration and occasional sadness.

Regardless of where you’ve found yourself this year, I want you to know that it is truly a pleasure to serve you, and I’m humbled by the opportunity to be there with and for you through it all.

So today, I want to share some key principles and practices that can truly make a difference in your financial future.

In other words, if we never get the chance to meet or work together, here are the Top 5 Things You Can Do TODAY To Improve Your Retirement Plan On Your Own.

1. Financial Planning is More

Than Just Investing

While investments play a crucial role in building wealth, true financial planning encompasses so much more.

Repeat after me: An investment strategy isn’t a financial plan.

In fact, if you want to get really technical (which we’ll discuss in Point #3) to arrive at the perfect investment mix for you, you first have to build the financial plan and then back into your investments. Not the other way around.

Your financial plan should be a comprehensive process that takes into account your entire financial picture.

From budgeting and saving to tax planning and estate planning, each aspect is interconnected and should be given due consideration.

A holistic approach is essential for long-term success.

If you’re curious about all of the areas you’ll want to take into consideration for you own plan, from taxes to long-term care that a typical financial plan covers, you can click on a sample of one below:

Click Here To View An Actual Financial Plan

2. Taxes Matter

It’s not about what you earn, but rather what you keep.

By strategically managing taxes today and developing a game plan for how you wish to withdraw your money in retirement, you can optimize your income and maximize your retirement savings.

This requires a proactive approach involving the understanding of tax laws, deductions, credits, and retirement account options to minimize the tax burden during retirement.

Effective tax planning can help you preserve your hard-earned savings, ensure a sustainable income stream, and potentially reduce your overall tax liability.

It also creates the space for you to make more informed decisions about your investments, withdrawals, and estate planning, ensuring a stable and comfortable retirement lifestyle.

So make sure you have a plan and account for taxes!

3. No Two Plans are Identical

Your Plan Must be Personal & Tailored to YOU and YOUR NEEDS

Financial planning is not a one-size-fits-all solution.

Each individual has unique circumstances, goals, and risk tolerances.

Therefore, a personalized approach, tailored to your specific needs, is vital for success.

So how do you achieve that?

Start by answering what’s most important to YOU.

Not your neighbor, relatives, or what you think others would want you to answer. Start by answering what is it you want out of this one beautiful life!

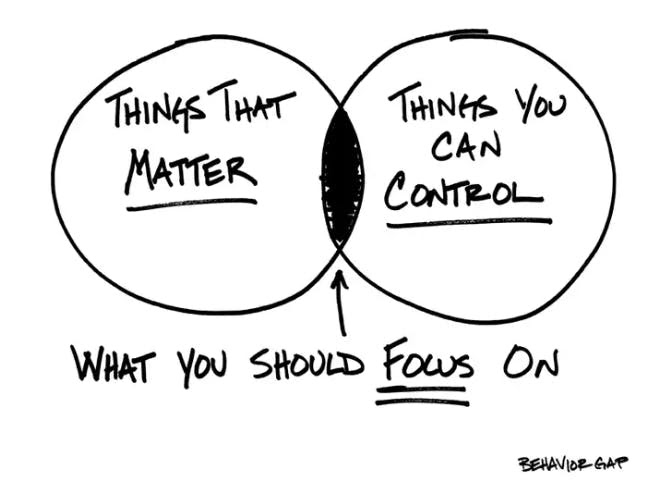

From here, now you can begin to plan around YOUR WHY.

This WHY must be your True North and guide all of your financial decisions.

With YOUR WHY squarely at the center of your new financial plan, you must work backward from here and begin asking questions like:

- How much money will I need annually?

- How much do I have saved today? Is that enough?

- How far away are I from achieving “X” goal?

- How many more years will I need to continue to work OR what monthly expenses can I cut down on to retire early?

- What about taxes and healthcare?

- Should I sell my house and downsize or relocate out of state?

Once you have some of those answers, you can begin to model your investment allocation to ensure you have a healthy mix of safety and growth assets to achieve your goals for both today and in the future.

Remember: It’s the planning that drives the investment decisions.

Not the other way around.

Always start with the planning, then build the investments to support the plan!

4. Regular Monitoring and

Making Adjustments is Crucial

Financial planning is not a one-time event; it’s an ongoing process.

Life is constantly changing, and so are your financial circumstances.

Regularly reviewing your plan and making necessary adjustments is crucial to ensure you stay on track.

Far too often I’ve worked with clients to build and implement the PERFECT financial plan, but guess what??

Life happens and that plan is no longer appropriate.

And that’s okay, it just means that it’s now time to recalibrate your plan.

When you recalibrate and make adjustments, it’s important to go back to the center, which is your Unique Why, and ask yourself if your goals are still the same as they were when you originally built the plan.

If your goals have changed, then you can go back to Step 1 and start over.

Remember: Financial planning is not a one-time event; it’s an ongoing process.

When adjustments don’t happen and you let your plan drift, I’ve witnessed (and cleaned up) horror stories of prospective clients who had the perfect financial plan ten or twenty years ago, and then forgot to revisit it, only to have it fall apart because it was no logner appropriate and the investment risk they took on was far too aggressive or their insurance policy lapsed, etc.

Don’t let this happen to you! Make sure your financial plan (and investments) are dialed in for where you are today!

5. Feeling Behind? There’s Still Time…

I Promise

I have witnessed numerous individuals and families become diligent about retirement planning in the last 5-10 years before retirement and achieve substantial progress.

Believe it or not, due to the following factors, you (as you approach) retirement are actually in a better position than any other age group to make significant progress simply by fine-tuning a few things and locking in.

To be honest, as you near retirement, you are probably an empty nester, your mortgage is almost paid off or has been refinanced at a reasonable rate, and you are earning at the highest point of your career.

All of this implies that with a few minor adjustments, you can take significant strides toward maximizing your retirement and setting yourself on the path to a successful retirement.